how to pay late excise tax online

THIS FEE IS NON-REFUNDABLE. For payment of motor vehicle excise tax or a parking ticket please have.

Online Payment Search Form.

. Late returns or payment are subject to penalties and interest. You can pay your excise tax through our online payment system. Tax Return Preparation 1 42.

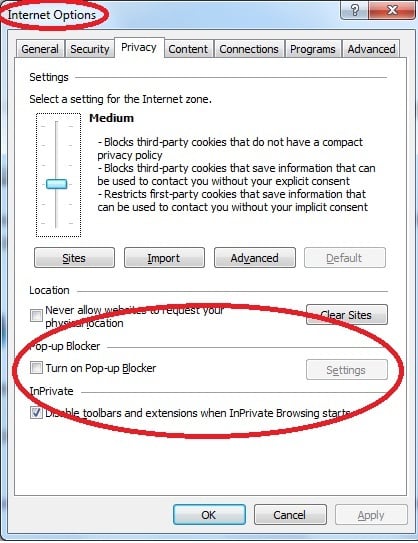

Go to our online system. Please note all online payments will have a 45 processing fee added to your total due. Interest will be charged on.

For EFTPS deposits to be on time you. Where do you pay late Motor Vehicle Excise taxes. An abatement is a reduction in your excise taxes.

Create account on Paygov. Fill out the form you need to file. We encourage you to submit your application ONLINE through our new portal linked below.

There will be a convenience fee associated with an online payment. Avalara solutions can help you determine excise tax and sales tax with greater accuracy. For example if you owe 2500 and are three months late the.

Use tax unlike sales tax is due at the rate where you first. Go to our online system. Current Fiscal Year Tax Rate.

Name A - Z Sponsored Links. Please complete all required fields electronically sign and upload the appropriate documents. You can pay your excise tax through our online payment system.

If you are not sure which form you need please visit. Pay your outstanding obligations online by clicking on the Green area on the home page. Kelly Ryan Associates 3 Rosenfeld Dr.

Penalties for filing late can mount up at a rate of 5 of the amount of tax due for each month that youre late. Not just mailed postmarked on or before the due date. Please have your bill handy.

Your 2020 annual excise tax returns must be filed on or before January 14 2021. Hopedale MA 01747 508-473-9660. Avalara solutions can help you determine excise tax and sales tax with greater accuracy.

You must have Signing. You need to enter your last name and license plate number to find your bill. Excise taxes are taxes that are imposed on various goods services and activities.

Select the TTB form you want to file. You can file a boat excise abatement for a couple of different reasons including if. Request for Tax Information.

How to pay late excise tax online Tuesday March 8 2022 Edit. Pay Excise Tax in Dallas TX. TEXNET ACH Debit payment of 1000000 or less must be scheduled by 1000 am.

The city or town where the vehicle is principally garaged levies the excise. PROCEED TO THE DEPUTY COLLECTOR SERVICE FOR. Once completed click the NEXT button within the option you choose.

You must deposit all depository taxes such as excise tax employment tax or corporate income tax by electronic funds transfer. Once you have downloaded. Such taxes may be imposed on the manufacturer retailer or consumer depending on the specific tax.

Visit their website here. The tax collector must have received the payment. Ad Avalara excise tax solutions take the headache out of rate determination and compliance.

Payment at this point must be made through our Deputy Collector Kelley. - Personal Property Taxes - Real Estate Taxes - School Department - Trash. Submit your report by logging in to your Alcohol Industry Management System AIMS account and looking for the File Excise Tax option on the dashboard for your business entity.

CT on the due date. Sequentially number your excise tax returns for the entire calendar year and start your serial numbers over at 01 at the beginning of each calendar year. Your boat was traded stolen or sold.

Ad Avalara excise tax solutions take the headache out of rate determination and compliance. Payment by credit card or electronic check may be made online through Invoice Cloud. All Massachusetts residents who own and register a motor vehicle must pay the motor vehicle excise annually.

Excise tax return extensions. Payments above 1000000 must be initiated in the. - Delinquent Excise Taxes.

Where do you pay late Motor Vehicle Excise taxes. File TTB form on Paygov. How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal.

A motor vehicle excise is due 30 days from the day its issued. You need to enter your last name and license plate number to find your bill. The use tax rate is the same as your sales tax rate.

You must file an excise tax. Acknowledge the warning banner by clicking the button marked CONTINUE.

Pin By Chris G On Vintage Electronics Vintage Electronics Low Tech Design

Online Bill Payments City Of Revere Massachusetts

Worthwhile Canadian Initiative 150 Years Of Federal Consumption Taxation

Worthwhile Canadian Initiative 150 Years Of Federal Consumption Taxation

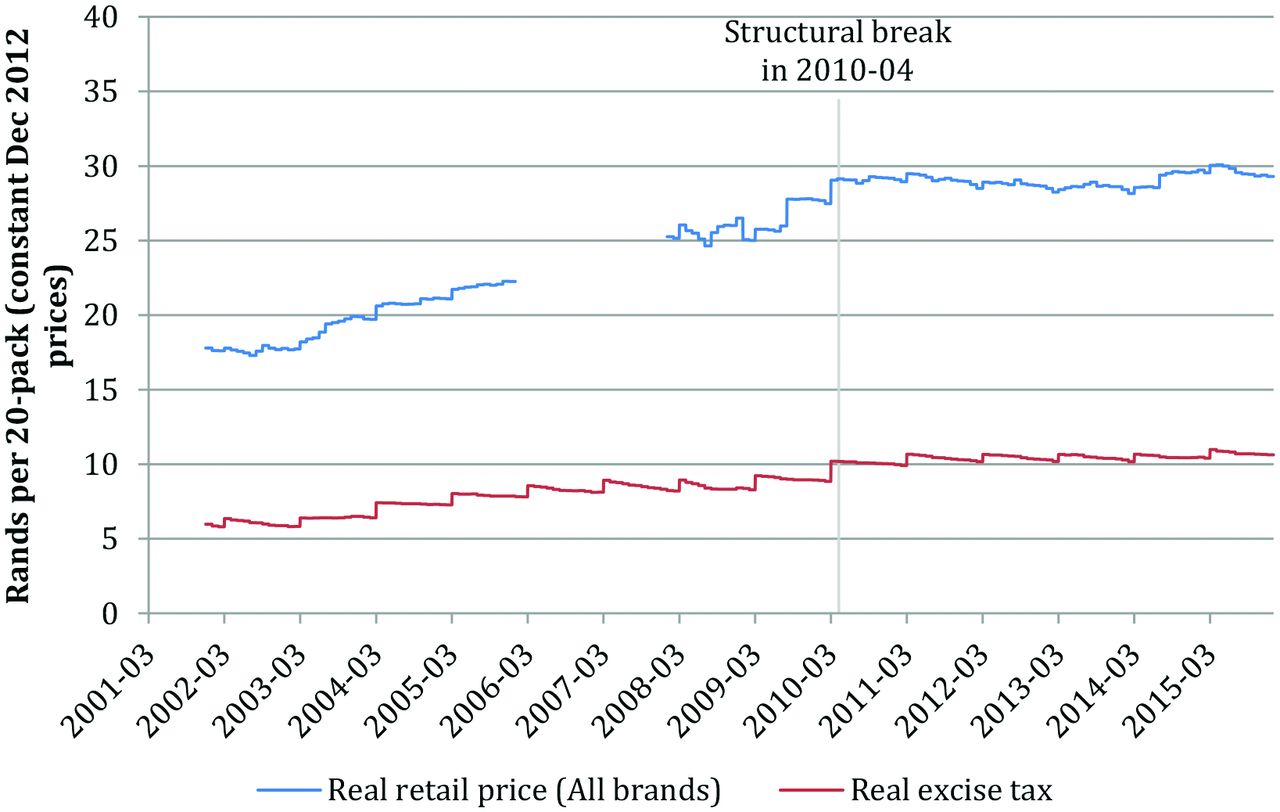

The Effect Of Excise Tax Increases On Cigarette Prices In South Africa Tobacco Control

The Effect Of Excise Tax Increases On Cigarette Prices In South Africa Tobacco Control

Characteristics Of Different Types Of Tobacco Excise Tax Structures Download Table

New Gst Registration Procedure Gst Number Blog Tools Registration Confirmation Letter

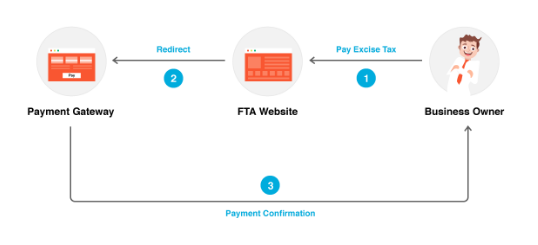

Excise Tax Return Filing And Payment Zoho Books

What Does The Cannabis Excise Stamp Mean For Distributors Of Cannabis Products Youtube

Distilled Spirits Excise Tax Rates Around The Globe Five X 5 Solutions